Rent-to-own agreements offer a mix of renting and the possibility of buying, but they bring some unique risks for tenants. Not every state has your back—knowing where the laws favor you can make all the difference.

States like California, New York, and Massachusetts really stand out when it comes to protecting your rights in rent-to-own contracts.

These states have clearer rules about rent payments, contract terms, and eviction processes that are actually tailored for rent-to-own setups. So if things get messy, you’ve got a better shot at fair treatment and legal help.

More people are turning to rent-to-own to build credit and, hopefully, buy a home. Lawmakers are starting to notice and update the rules to give tenants more security.

Key Takeaways

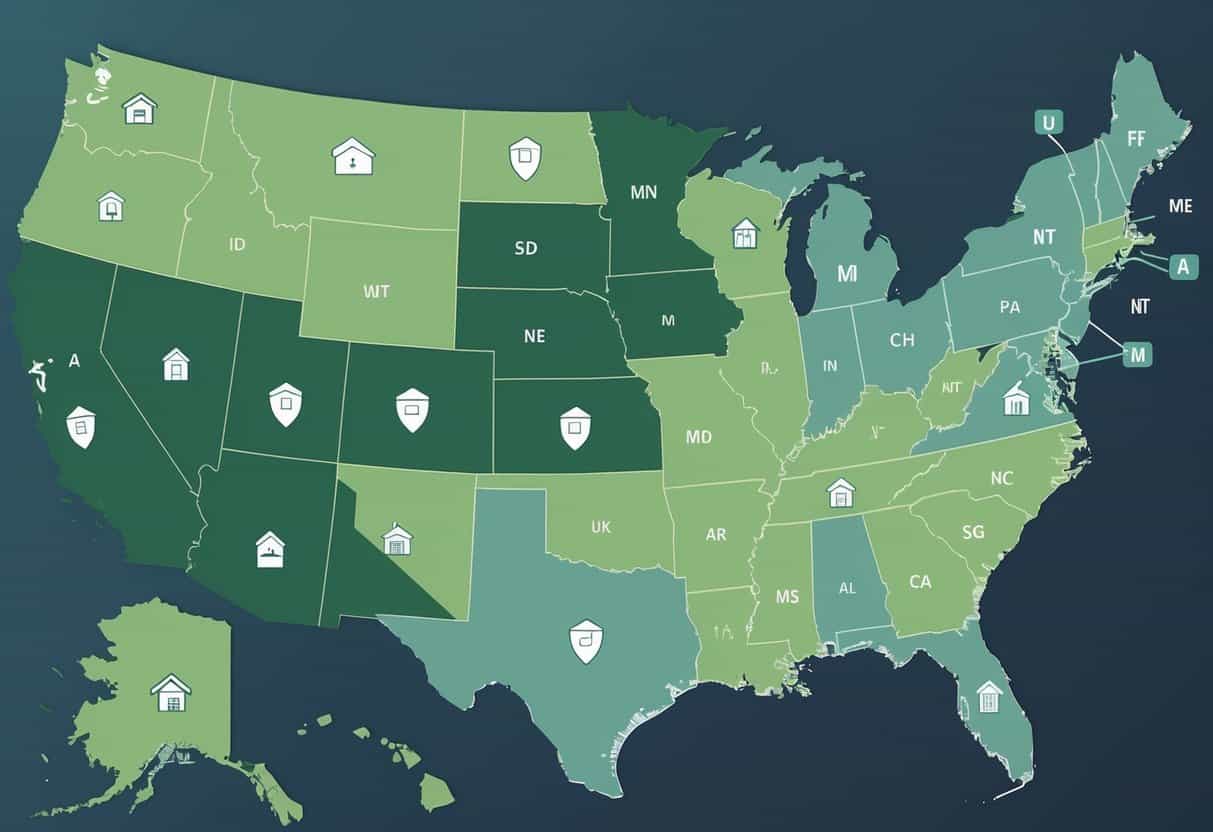

- Rent-to-own tenant protections are all over the map—literally.

- Some states go out of their way to give you specific rights in these contracts.

- Keeping up with local laws can help you steer clear of big risks and get closer to owning your place.

Overview of Rent-to-Own Tenant Protections

Rent-to-own agreements are a weird hybrid, so your rights aren’t quite like a normal rental or a standard home purchase. What you get depends on rules about contracts, eviction, and payments.

States handle these things their own way, and there’s no one-size-fits-all.

Key Legal Rights for Rent-to-Own Tenants

Your rent-to-own contract should lay out the purchase price, rent amount, and how much of your rent gets credited toward buying the home. All of this needs to be in writing.

You’re usually protected from eviction as long as you stick to the contract and pay on time. In some states, landlords need a real reason—not just late rent—to evict you.

Depending on where you live, you might have rights when it comes to repairs and upkeep. Landlords often have to keep the place safe and livable while you’re renting.

These rules can affect whether you get to finish the purchase or just stay in the home.

Differences Between Rent-to-Own and Traditional Rentals

With a regular rental, you pay to live there, and that’s it—no promise of ownership. Rent-to-own? Part of your rent might go toward buying the place down the line.

Rent-to-own contracts are usually longer and more complicated. You’ll need to watch out for deadlines and fees if you decide not to buy.

If the landlord doesn’t keep up the property, or if you can’t get financing when it’s time to buy, you could lose your investment. That’s not usually a risk for traditional renters.

Why Tenant Protections Vary by State

States all have their own take on rent-to-own protections. Some have clear rules, while others just treat it like a normal rental or sale.

Take California and Oregon—they offer stronger eviction protections that can help you in a rent-to-own deal. Other states lean more toward landlord rights, making eviction easier.

Property tax rules and rent control laws change from state to state, too. That affects what you pay and how your agreement gets enforced.

Knowing your state’s laws before you sign anything is pretty much essential.

States with Comprehensive Rent-to-Own Tenant Laws

A handful of states actually spell out protections for rent-to-own tenants. These rules usually cover contract details, payment handling, and what happens if things fall apart early.

Knowing these can save you from losing money or getting stuck with unfair terms.

California’s Rent-to-Own Regulations

In California, your rent-to-own contract has to be in writing and show the rent, option fee, and purchase price. You get three business days to back out, which is honestly pretty helpful.

There are limits on how much rent can go toward the purchase price. Landlords also have to tell you if the place has legal issues or needs repairs.

If you miss payments or want to leave, California law says the landlord has to notify you and explain your rights. This helps protect you from getting kicked out or losing your option fee for no good reason.

New York’s Consumer Protection Measures

New York treats rent-to-own deals as a mix of rental and purchase. Your contract has to spell out how much rent goes toward buying and the timeline.

You’re covered by general consumer protection laws here. Landlords have to be fair with option fees—they can’t just keep them if you’re not at fault for canceling.

There are clear rules on eviction notices, and you get a chance to fix problems before you’re out. That’s a big deal if you’re trying to hold onto your shot at homeownership.

Texas Rent-to-Own Statutes

Texas doesn’t have a special rent-to-own law, but general tenant and contract rules apply. Your contract should make payment terms and buying deadlines clear.

If the landlord breaks the deal or the place isn’t livable, you can get your option fees back. Landlords have to keep the property up and give proper notice before eviction.

Texas tends to favor landlords, so you really need to read every word before signing. A clear, detailed contract is your best bet for protecting your money and rights.

Notable State-Specific Tenant Protections

Some states lay out exactly what has to be disclosed and how rent-to-own agreements should be handled. If you know these protections, it’s easier to dodge hidden fees and unfair terms.

Illinois Rent-to-Own Disclosure Requirements

In Illinois, your rent-to-own contract has to lay out the total price, monthly payments, and how much goes toward buying the place. You also need to know the property’s condition.

Landlords have to give you a written copy of the agreement before you sign. It needs to state your rights, the lease length, and how you can cancel.

If the landlord skips these details, you might be able to cancel the contract without a penalty. That’s a nice bit of security for anyone jumping into a rent-to-own deal.

Minnesota’s Fairness in Rent-to-Own Agreements

Minnesota’s laws are pretty strong when it comes to fairness. Contracts have to show exactly how your payments are split between rent and the purchase price.

The contract also needs to say when you can buy the property—no moving goalposts. You get a fair shot to inspect the home before signing, too.

Landlords can’t hide sneaky fees or penalties. If you stick to the agreement, you’re guaranteed the option to buy without surprise charges.

Emerging Trends and Ongoing Policy Developments

A lot of states are starting to update their laws to better protect rent-to-own tenants. There’s movement on things like sealing eviction records and boosting tenant rights.

Recent Legislative Changes Impacting Tenant Rights

In 2024, several states passed laws to keep eviction records from ruining your chances of renting in the future. These laws focus on sealing or expunging eviction records so they don’t follow you forever.

Some states updated rent control rules, which can affect your rent-to-own agreement by limiting how much landlords can raise rent or tack on fees.

It’s worth keeping an eye on your local rules, since new laws can pop up anytime. Many of these changes are meant to stop landlord harassment and unfair evictions.

Advocacy Efforts and Future Directions

Tenant rights groups are stepping up to push for stronger protections for rent-to-own tenants. They’re calling for clearer contract rules and safeguards against sudden rent hikes or sneaky fees.

Advocates are also fighting for better access to legal help. The hope is that this could cut down on evictions and make it easier for tenants to stand up for themselves.

Pretty soon, you might notice more policies that force landlords to lay out all the details upfront. Honestly, these changes are about making rent-to-own agreements less confusing and, well, a bit fairer for tenants.