If you’re hoping to trim your monthly bills, knowing which states have the lowest utility costs might help you make smarter choices about where to live—or just how to budget. States like Utah, New Mexico, and Colorado are known for some of the lowest electricity rates in the country, so your home expenses could be a lot lower there.

That kind of savings can really shift your overall cost of living, honestly.

Utility costs swing a lot depending on your state, the local climate, and what energy sources are nearby. Understanding these factors is key if you want to keep your expenses in check.

Picking a state with lower utility bills means you can control one of the biggest monthly costs of homeownership, without necessarily sacrificing comfort.

Key Takeaways

- Lower utility costs can cut your monthly home expenses.

- Electricity rates aren’t the same everywhere—they jump around a lot by state.

- Where you live really does impact your utility spending.

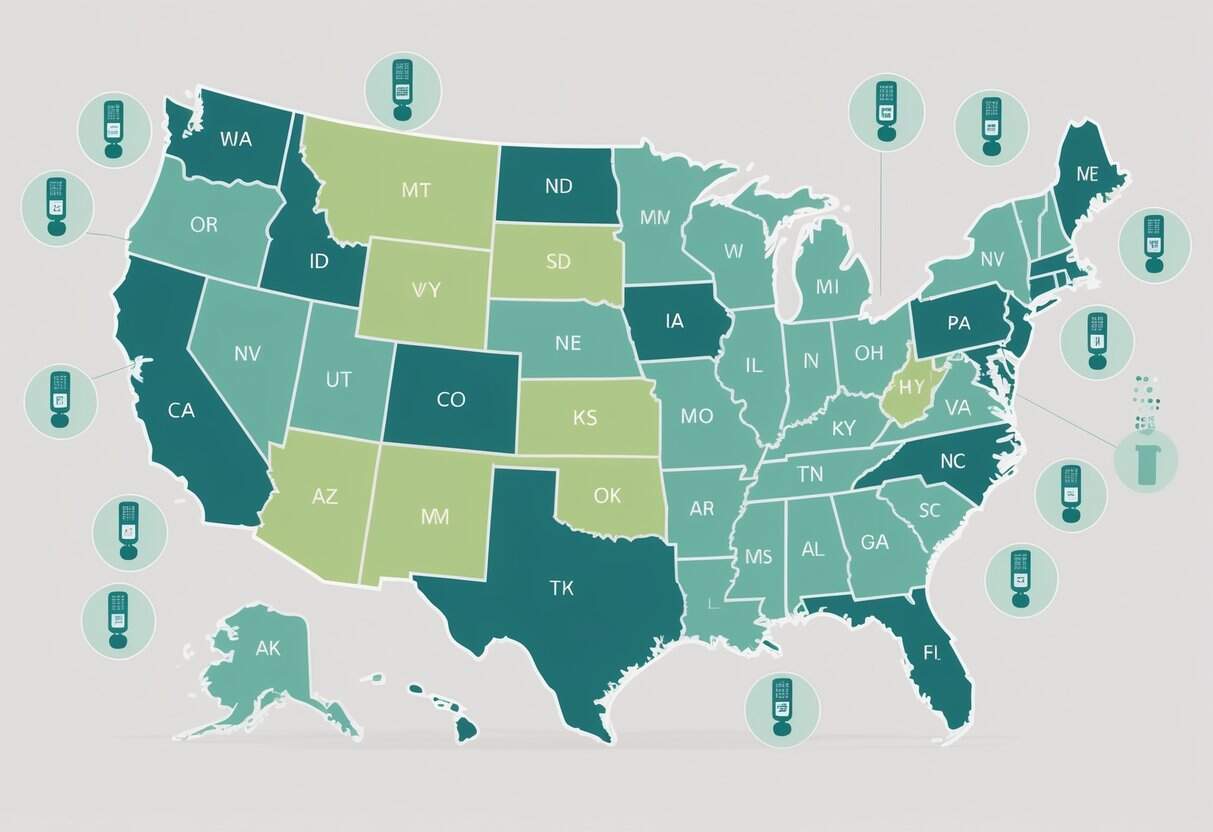

Top States with the Lowest Utility Costs

Some states just have lower utility bills, plain and simple. Electricity prices, natural gas, and the local climate all play a role in what you pay each month.

The states with the lowest costs tend to have affordable energy rates and solid infrastructure.

State-by-State Utility Cost Rankings

New Mexico, Colorado, and Wyoming usually land near the top for low electricity costs. New Mexico’s average monthly electricity bill sits around $96.28. Wyoming is close at $101.32.

Other states like Kansas, Pennsylvania, and Michigan also keep utility bills relatively low.

Here’s a quick rundown of some of the states with the best utility costs:

- New Mexico: $96.28 average electricity bill

- Colorado: $100.49 average electricity bill

- Wyoming: $101.32 average electricity bill

- Kansas, Pennsylvania, Iowa, Michigan: Known for low utility bills overall

These numbers can give you a sense of where you might pay less if you’re thinking about moving, or just want to see how your own bills stack up.

Profile of the Most Affordable States

Affordable states often mix cheap electricity with reasonably priced natural gas. Kansas and Pennsylvania, for example, balance low electricity prices with other manageable utility expenses.

In some of these places, utility costs might be just 6-7% of your income—which is below the national average.

States across the Midwest and Mountain West tend to have steady infrastructure and easier access to cheaper energy, so homeowners there usually pay less each month.

Comparison of Regional Trends

You’ll notice the lowest utility costs popping up in the Midwest, Mountain West, and parts of the South. These regions usually benefit from local energy production and don’t need to crank the AC as much as hotter states.

Northern Plains states like North Dakota also have low electricity prices, thanks in part to local resources. On the other hand, coastal and densely populated states tend to have higher utility costs, mostly because of infrastructure and heavy energy demand.

Living somewhere with tough winters? Your heating costs might spike. If you’re in a hotter state, air conditioning could be your main expense.

It’s worth thinking about both the climate and the local rates when you’re estimating your utility costs.

Factors Impacting Utility Costs for Homeowners

A bunch of things can push your utility costs up or down. The climate, available energy sources, state rules, and your own habits all play a part.

Climate and Seasonal Variations

Where you live really does affect your bills. Colder states? You’ll probably spend more on heating in winter. Hotter states? Expect higher cooling costs when summer hits.

Seasonal changes mean your bills can bounce up or down throughout the year. You might use more electricity in the summer for fans or AC, and in winter, heating costs can climb in chillier places.

Think about how long the heating or cooling season lasts where you are. Mild climates usually mean lower utility costs, since you don’t need to run the furnace or AC as much.

Energy Sources and Infrastructure

The kind of energy your state uses matters, too. Some states rely on cheaper natural gas, while others might depend on pricier options like oil or even renewables.

Efficient power plants and a solid grid can help keep costs down. If your state keeps its infrastructure up-to-date, you might see lower bills.

Fuel prices shift, and that can impact your monthly rates. When natural gas or coal prices go up, so do your bills. A mix of energy sources can keep things a bit more stable.

State Regulations and Policies

State governments have a big say in what you pay. Some states push for competition among utility companies, which can help lower prices.

Others have consumer protections or offer subsidies and discounts for low-income households. These policies can really cut your costs.

Taxes on utilities also differ by state. Some places tack on extra fees, while others might charge less. States that encourage renewable energy sometimes have higher prices now, but maybe savings later. Hard to say for sure.

Household Consumption Patterns

How you use energy at home is a big factor. Bigger homes or more people usually mean a bigger bill.

Old or inefficient appliances can waste energy and bump up your costs. Keeping your HVAC and appliances updated can save you money over time.

Your habits matter. Leaving lights on, running the dryer during peak hours, or cranking the heat or AC more than you need will all show up on your bill.

Paying attention to your energy use and making small tweaks can add up to real savings.

How to Benefit from Living in Low-Utility-Cost States

If you end up in a state with low utility costs, you can save money and boost your home’s energy efficiency. There are a few ways to get the most out of those savings.

Maximizing Utility Savings

Start by looking for energy-efficient appliances that fit your climate. Smart thermostats can help you control heating and cooling throughout the day.

Sealing up leaks around windows and doors keeps energy from slipping away. Regular HVAC maintenance helps, too.

Check if your state offers rebates or programs for energy upgrades. Some places have assistance programs like LIHEAP for low-income households, which can make a real difference.

Relocation Considerations for Homeowners

If you’re thinking about moving somewhere with lower utility costs, dig into local rates for electricity, water, gas, and waste management before you buy.

Don’t forget the climate. States with mild weather usually mean lower heating and cooling bills, but things like local taxes or home prices might balance out those savings.

Look up whether your new state has energy assistance programs and check average home energy use. That way, you’ll have a better idea of what your total monthly expenses might look like.

Long-Term Financial Impacts

Lower monthly utility bills mean you’ve got a bit more cash left over. That extra money can go toward paying off your mortgage faster, or maybe saving up for a kitchen remodel.

Reduced energy costs might even nudge your home’s resale value higher. Buyers these days seem to appreciate homes with lower operating costs.

Spending less on utilities can give your finances a little more breathing room. Over time, those savings pile up, and honestly, it just makes life feel a bit less stressful.