A housing bubble is what you get when home prices shoot up way too fast and then drop off a cliff. That kind of mess can be rough for buyers, sellers, and, honestly, the whole economy.

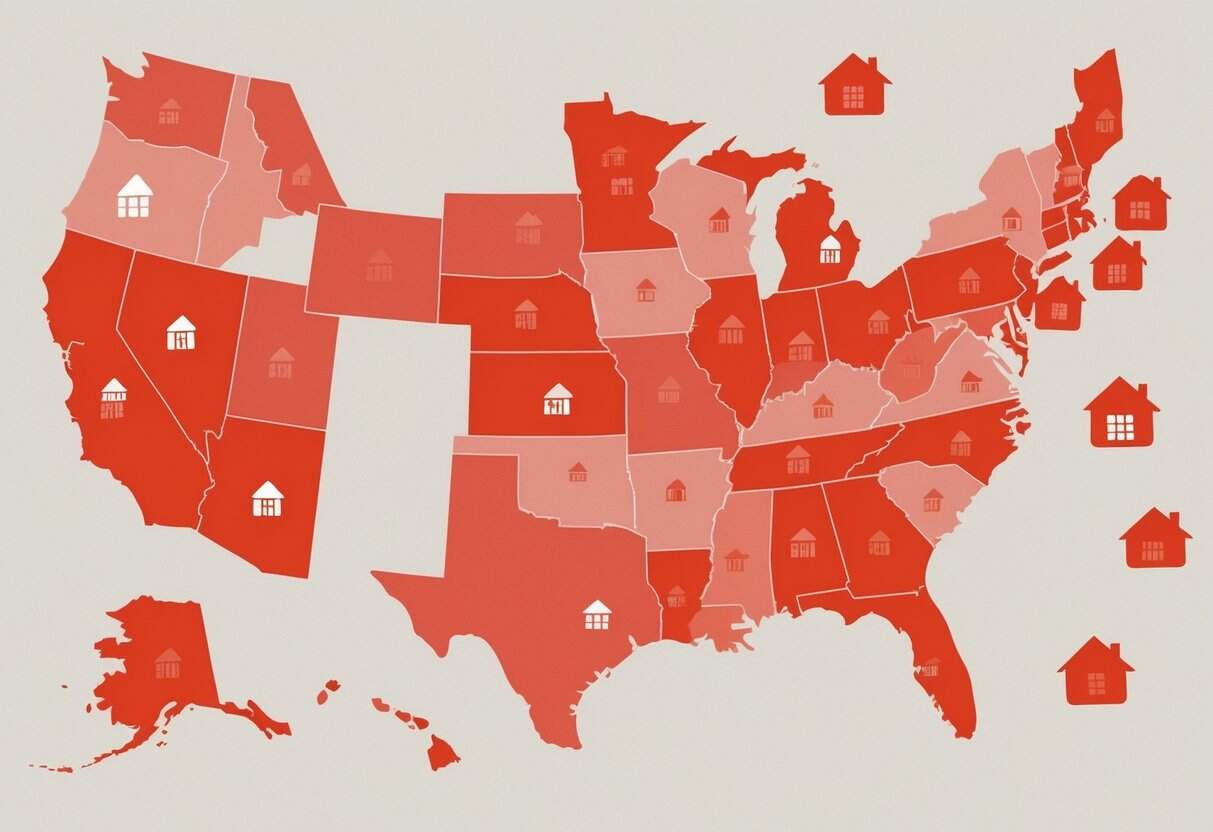

Right now, a handful of states are flashing warning signs for a possible bubble in 2025. California, Illinois, and New York are at the top of the list for a potential housing market downturn this year.

These states have sky-high housing prices and economic pressures that could easily tip things the wrong way. Florida, Nevada, and New Jersey aren’t exactly in the clear either, with similar issues brewing.

If you’re thinking about buying or selling soon, knowing which areas are shaky might help you dodge some headaches.

Key Takeaways

- Some states are showing real signs of housing market risk in 2025.

- High prices and economic stress are making things unstable.

- Knowing where the trouble spots are could help you plan ahead.

Key Indicators of a Housing Bubble

It’s smart to watch for warning signs if you’re worried about a housing bubble. Stuff like home prices rising super fast, high price-to-income ratios, and a bunch of real estate speculation should make you pause.

Each of these tells a slightly different story about what’s going on in the market.

Rapid Home Price Appreciation

When home prices jump quickly in just a year or two, that’s a classic bubble red flag. Usually, these price hikes leave wage growth and inflation in the dust.

That makes homes way less affordable—people end up stretching their budgets, sometimes way too far.

If you see prices climbing 20% or more in a year while incomes barely budge, it’s not a great sign. Buyers might be biting off more than they can chew just to get a place.

Investors get drawn in by the fast gains, which only pushes prices up more. But that kind of cycle can’t last, and when it breaks, the fallout isn’t pretty.

High Price-to-Income Ratios

Price-to-income ratio is just what it sounds like: median home price divided by median household income. When that number gets too high, homes are out of reach for most people.

A ratio above 5? That’s usually a warning that buyers would need more than five years’ worth of income to buy a home.

Most healthy markets hover closer to 3 or 4. In places like California and Florida, the ratio’s blown past 5.

That means a lot of folks are struggling to qualify for mortgages or keep up with payments.

Surge in Real Estate Speculation

Speculators are buyers who just want to flip homes for a quick profit. When there’s a lot of that going on, prices can get weirdly inflated.

You’ll notice this when there’s a spike in cash purchases or homes changing hands way too fast. More speculation means more price swings—markets get jumpy.

Some cities have seen this lead to more foreclosures and empty houses, which doesn’t help neighborhoods at all.

It’s worth keeping an eye out for signs of speculation to figure out if price growth is real or just hype.

States Most At-Risk of a Housing Bubble in 2025

Some states are showing clear signs of bubble risk—stuff like price swings, affordability problems, and rising foreclosures. The reasons can vary a lot by location, but it’s all worth watching.

Market Analysis of At-Risk States

California, Illinois, and the New York City area really stand out for 2025. These places have high foreclosure rates and prices that just keep slipping.

Nevada and Florida aren’t far behind, though maybe not quite as shaky.

You’ll spot price drops in metros like San Diego, Austin, and Miami. Some markets are losing value, while others are holding steady.

It’s a weird mix of falling demand and too many homes for sale.

Here’s a quick breakdown:

| State | Risk Level | Key Issues |

|---|---|---|

| California | Very High | Foreclosures, affordability |

| Illinois | High | Price decline, economic stress |

| New York City | High | Market corrections, foreclosures |

| Nevada | Moderate to High | Price volatility |

Factors Driving Elevated Risk

Home prices keep rising, but incomes aren’t keeping up. That’s pushing a lot of buyers out of the market in these riskier states.

Foreclosure rates are ticking up, especially in places like California and Illinois. Mortgage rates aren’t helping either—higher monthly payments make it easier to fall behind.

If the local job market is shaky, that adds even more pressure. Some states just don’t have the economic strength to weather big market swings.

Recent Policy Changes Affecting Risk Levels

A few states have tried to cool things off with new housing regulations and tax tweaks. Rent control and property tax changes are supposed to help with affordability.

At the same time, stricter lending rules are making it tougher to get a mortgage. That might slow down demand, but it could also drag out price corrections.

It’s hard to say how much these policies will matter in the end. Zoning changes and mortgage rules could shift things again soon.

Regional Trends and Contributing Factors

It’s not just prices and policies—migration, jobs, and housing supply all shape the bubble risk in different states.

Migration Patterns Influencing Demand

Where people are moving has a big impact. States like California and Illinois are losing more people than they’re gaining, which means fewer buyers and homes sitting on the market longer.

That can push prices down. Meanwhile, some areas are pulling in new residents and seeing demand spike.

But if those migration trends reverse, prices can fall just as fast as they went up. Watching where people are headed is pretty important.

Economic and Employment Conditions

The local job scene matters a lot. States with slow job growth or rising unemployment just don’t have the same housing demand.

Illinois and New Jersey are both feeling the drag from weaker economies. That makes it harder for people to buy or keep their homes.

If your area is losing jobs or key industries, home prices could take a hit.

Inventory and Construction Trends

Housing supply is another big piece. If builders crank out a bunch of new homes and buyers can’t keep up, prices start to slip.

California and Florida have seen more construction, but with affordability so bad, not many can actually buy.

On the flip side, if there aren’t enough homes for sale, prices stay high—at least until a bunch of unsold homes pile up. Watching new permits and inventory numbers can give you a sense of what’s coming.

Potential Consequences and Outlook

Depending on whether you own, want to buy, or invest, these market risks could hit you in different ways. The market might stay sluggish for a while, and home values aren’t guaranteed to climb.

Impact on Homeowners and Buyers

If you already own a home in a risky state, you might see your property value stall or drop. That makes it tough to sell or move, especially if your mortgage is bigger than what your home’s worth.

For buyers, high prices and mortgage rates are still a hurdle. There just aren’t many affordable options out there right now.

And in some places, property taxes are creeping up, making it even pricier to own.

Implications for Real Estate Investors

Investors should tread carefully in high-risk states. Prices could dip or just stay flat, which isn’t great for returns.

On the plus side, more people might rent if buying is out of reach, so there could be rental opportunities. Still, higher foreclosure rates mean more competition and more risk.

It’s smart to look at local job trends and population shifts before jumping in. Sometimes, waiting it out is the better move.

Forecast for Housing Market Stabilization

The U.S. housing market should grow slowly in 2025, maybe less than 3%. So, if you’re hoping for a big bounce, that’s probably not happening.

In some states facing higher risks, prices might just stall—or even dip a bit. Affordability and economic uncertainty are still big hurdles, which could keep demand on the lower side.

Government policies and mortgage rates will shape how fast things settle. Honestly, it’s probably wise to expect a cautious market, with only modest price growth for now.